Technologies in financial services

Front Office quantitative trading technologies have historically involved self-build to gain alpha. Managing teams to enable the review of an architectural stack is challenging due to the complexity and frequent lack of documentation. Systems focussed primarily on the pricing, execution and risk aspect of trading tend to be developed by teams that focus on early delivery to achieve maximum gains rather than durability. Downstream technology stacks in the middle and back-office are skewed towards inhouse development but frequently depend upon legacy self-hosted third-party applications. These present their own issues associated with monoliths and long update cycles. Challenger firms and disruptors in the industry are not tied to such cost centres and are deploying directly to cloud with small technology footprint solutions. Their deployments can be continuous and multi-region SaaS due to their limited exposure to legacy tech. Latterly we have seen investigations into large dataset rendering, machine learning in-cloud, and other periodic high load work such as backtesting. Now that the market data vendors are beginning to ship data natively in-cloud and with lower latency, full cloud-native stack hosting has become tractable for a broad range of use cases.

Financial asset classes and products

Trading platforms are only a part of the solution. It is also necessary to pair technology with an understanding of the products that are traded. "Doing time" on a trading desk is a great help when understanding the use cases we need to review. A trading environment focussed on IR structured/exotics, semi-vanilla and vanilla IR derivatives and hedge instruments, that might also includes hybrids would typically see a low volume, low cadence trading profile coupled with high complexity in the associated risk generation. Conversely cash products such as fixed income and equities including exchange traded derivative requires a dramatically different treatment focussing on volume processing and latency with PnL and risks feeding back to algorithms within microseconds and to humans in milliseconds. The trade volumes often generated by systematic trading strategies are often (but certainly not always) substantially larger than previously observed. Therefore latency and volume must both be addressed. Knowing the use case of the data in a trading scenario, and the likely complexity of the related trade processing is key.

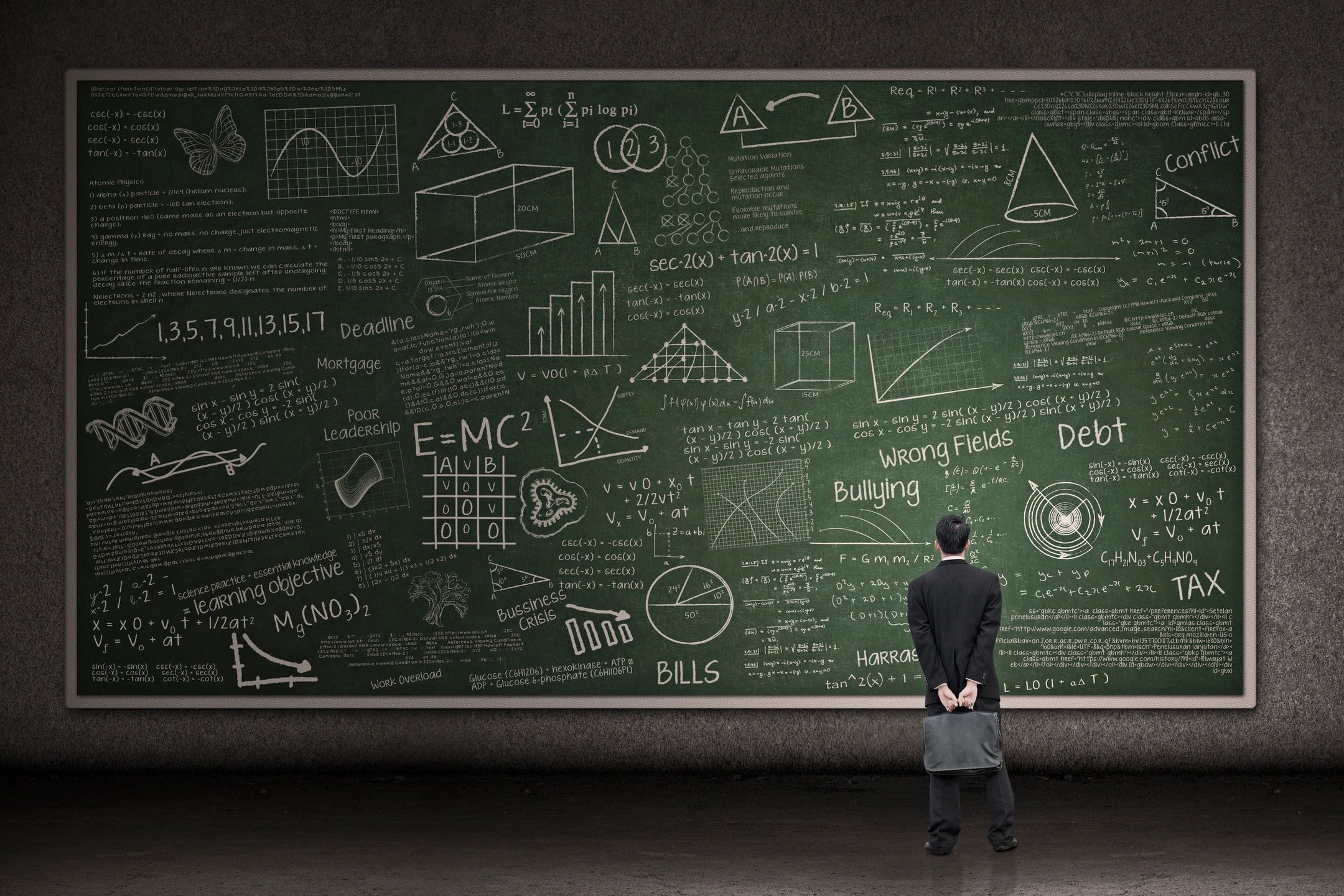

Team leadership

Even a fully in-cloud technology stack requires someone to mind the shop, or at least negotiate the contracts. Your analysts, development, implementation, support and maintenance team needs to fit the requirements of your business model. Getting the balance of technical and business skills right requires support and TLC. Kanban and Scrum models of development are now commonplace but need to accommodate support schedules and spikes, especially in a devops environment. Globally distributed support and development teams require thought and planning relating to their communication channels, the maintenance of shared information, and how regional handovers are conducted for live issues as well as ongoing distributed development work. Appropriate tooling and sensible, agreed procedures having minimally adequate complexity are key to removing friction from the system.